Home office depreciation calculator

Dryer - Electric. What is the depreciation period for a new concrete pad to park business trailers and van at home office.

Depreciation Schedule Template For Straight Line And Declining Balance

The depreciation calculations will continue until the final value of the asset reaches zero.

. You recover the costs through depreciation amortization or cost of goods sold when you use sell or otherwise dispose of the property. Depreciation on buildings Depreciation was allowed on most buildings until 2010 and for the 2012 2020 income years the depreciation rate for buildings with an estimated life of more than 50 years was set at zero. These items have been filtered to our Furniture category.

If the interest rate is known use the Fixed Rate tab to calculate the monthly payment. The tool includes updates to reflect tax depreciation incentives for eligible businesses including. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST 1-800-843-5678 if you recognize a child.

Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. If youre not sure how much rent youll receive from your property use 4 of the value for a house or 5 for a unit or townhouse. Repairers builders and home inspector associations and insurers.

Backing business investment accelerated depreciation. How is depreciation calculated. The 2022 Section 179 Deduction Limit for Businesses is 1080000 Jan 4 2022 In addition businesses can take advantage of 100 bonus depreciation on both new and used equipment for the entirety of 2022.

How to claim your home office expenses when working from home Home Office Calculator. Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3. Diminishing Value Depreciation Method.

Camel Saddle - Footstools. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of. It would generally be 15-year property.

Calculate Property Depreciation With Property Depreciation Calculator. If the monthly payment is known use the Fixed Pay tab to calculate the effective interest rate. How to calculate the tax for a Small Business Corporation SBC Income Tax.

Card Tables Chairs - Heavy Chrome. Consult your nearest SSA office. The cash flow calculator needs to know your taxable income so that it can work out the benefits you may receive from depreciation and negative gearing.

We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time. Bentwood Chairs - Rattan Wicker. We set depreciation rates based on the cost and useful life of assets.

Car Depreciation Calculator. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. You wont owe depreciation recapture on your primary residence unless you took deductions on it as a home office.

If he didnt claim his home office Joe would have owed 765 of self-employment tax on his 5000 of net income. The Depreciation Calculator computes the value of an item based its age and replacement value. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property.

The most common method of calculated depreciation the General Depreciation System spreads depreciation equally over a term of 275 years for residential buildings. The home office deduction calculator is the easiest way to find out how much home office deduction Also read the frequently asked questions on office deduction. Depreciation rates Assets are depreciated at different rates.

The Worksheet mode includes tables for amortization bond depreciation and compound interest Built-in memory for storage of previous worksheets Can perform cash-flow. Texas Instruments BA II plus Financial Calculator for business professionals and students features are that it performs common math as well as various financial functions. Depreciation on home office.

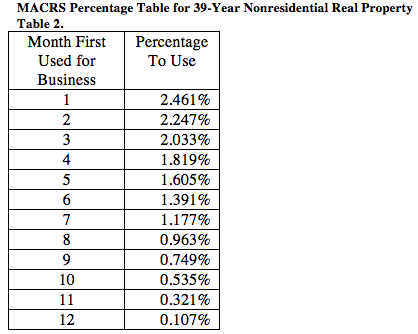

Per IRS Publication 946 - IRSgov How To Depreciate Property Section 179 Deduction Special Depreciation Allowance MACRS Listed. In Form 8829 Part III provides the way to figure your. Here total sales are equal to total revenue of a company.

The Lease Calculator can be used to calculate the monthly payment or the effective interest rate on a lease. BMT Tax Depreciation works with your accountant to ensure that your depreciation claim for your investment property is maximised each financial year. Finally this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F Form 1040 or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the.

The Depreciation Calculator computes the value of an item based its age and replacement value. Temporary full expensing originally applied until 30 June 2022 and it has now been extended until 30 June 2023. These items have been filtered to our Appliances - Major category.

Thats 215 in savings. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate.

Prime Cost Depreciation Method. You can also get a portion of depreciation related to the house in proportion to the area. If an asset costs 50000 and has an effective life of 10 years you can claim 10 of its cost in each of the ten years.

How to calculate the Section12C DepreciationWear and Tear allowance on plant and machinery used for manufacture s12c Wear Tear. Manufacturers repairers builders and home inspector associations and insurers. After claiming the home office deduction he ended up owing only 551 in self-employment tax.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

The Best Home Office Deduction Worksheet For Excel Free Template

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Simplified Home Office Deduction Explained Should I Use It

Rev Proc 2013 13 A New Option For The Home Office Deduction

Free Macrs Depreciation Calculator For Excel

Units Of Production Depreciation Calculator Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

Appliance Depreciation Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Depreciation Calculator Depreciation Of An Asset Car Property

Home Office Expense Costs That Reduce Your Taxes

How To Calculate Depreciation For Your Home Office Deduction Michele Cagan Cpa

Simplified Home Office Deduction Explained Should I Use It